News and

Announcements

Notice of the Average Weekly Wage for 2025

Virginia Department of Labor and Industry Recertifies NIBCO of Virginia as a Voluntary Protection Program ‘STAR’ site

RICHMOND – NIBCO of Virginia, located in Stuarts Draft, has received recertification as a Virginia STAR Worksite under the Virginia Occupational Safety and Health (VOSH) Voluntary Protection Programs (VPP). This is the site’s third recertification since 2014.

“We commend the dedication of the staff and management at NIBCO of Virginia for prioritizing workers’ safety and health,” said Virginia Department of Labor and Industry (DOLI) Commissioner Gary Pan. “This achievement demonstrates their commitment toward keeping workers safe.”

NIBCO of Virginia facility in Stuarts Draft, Virginia, is one of 37 current participants in the STAR program of public/private sector worksites to achieve and retain this recognition. The approximately 304,000-square-foot facility is the world’s largest producer of pure copper fittings for plumbing, heating, cooling, irrigation, and drainage applications. Currently, there are 460 full-time employees (27 salaried/ 433 hourly), with two contract workers at the site. The plant is one of two NIBCO VPP STAR sites in Virginia and one of five in the United States.

The Virginia VPP recognizes and promotes exceptional safety and health management systems for Virginia’s employers in all industries. In VPP, the participant’s management, workers, and VOSH establish a cooperative relationship that encourages continuous improvement in worksite safety performance.

Acceptance into Virginia’s VPP is confirmation and recognition that an employer has achieved safety and health excellence well above their industry peers. The VOSH VPP administers the Virginia STAR, Virginia Challenge, VADOC Challenge, Virginia BEST, and Virginia BUILT programs. For more information about this program or the other services we offer, visit our website at https://www.doli.virginia.gov/voluntary-protection-program/.

The Virginia Occupational Safety and Health (VOSH) program is financed in part by a grant from the U. S. Department of Labor, Occupational Safety and Health Administration (OSHA), under §23(g) of the Occupational Safety and Health Act of 1970. The Virginia State Plan is funded by a grant of federal funds, which constitutes 50% of the State Plan budget excluding any state overmatch funds. Zero percent, or $0.00 of the State Plan budget, is financed through nongovernmental sources.

Virginia Department of Labor and Industry Recertifies NAES Southampton Power Station as a Voluntary Protection Program ‘STAR’ site

RICHMOND – NAES Southampton Power Station in Franklin, Virginia, has received recertification as a Virginia STAR Worksite under the Virginia Occupational Safety and Health (VOSH) Voluntary Protection Programs (VPP). This is the site’s fifth recertification since 2004.

“We commend the dedication of the staff and management at the NAES Southampton Power Station for prioritizing workers’ safety and health,” said Virginia Department of Labor and Industry (DOLI) Commissioner Gary Pan. “This achievement demonstrates their commitment toward keeping workers safe.”

NAES Southampton Power Station is one of 35 current participants in Virginia’s VPP STAR Program. The location is owned by Dominion Energy, Inc., operated by NAES Corporation, and has been in continuous commercial operation since 1992. The facility is located on approximately 30 acres and employs 30 workers in Franklin, Virginia. The station produces enough electricity to power approximately 51,000 homes, using biomass as a fuel in the form of wood chips, grindings, and slash as its primary fuel.

The Virginia VPP recognizes and promotes exceptional safety and health management systems for Virginia’s employers in all industries. In VPP, the participant’s management, workers, and VOSH establish a cooperative relationship that encourages continuous improvement in worksite safety performance.

Acceptance into Virginia’s VPP is confirmation and recognition that an employer has achieved safety and health excellence well above their industry peers. The VOSH VPP administers the Virginia STAR, Virginia Challenge, VADOC Challenge, Virginia BEST, and Virginia BUILT programs. For more information about this program or the other services we offer, visit our website at https://www.doli.virginia.gov/voluntary-protection-program/.

The Virginia Occupational Safety and Health (VOSH) program is financed in part by a grant from the U. S. Department of Labor, Occupational Safety and Health Administration (OSHA), under §23(g) of the Occupational Safety and Health Act of 1970. The Virginia State Plan is funded by a grant of federal funds, which constitutes 50% of the State Plan budget excluding any state overmatch funds. Zero percent, or $0.00 of the State Plan budget, is financed through nongovernmental sources.

Suicide Prevention in the Workplace

September is National Suicide Prevention Awareness Month, the perfect opportunity to discuss the ongoing mental health crisis, alarming increase of work-related suicides, and what you can do to help.

In recent years, the Occupational Safety and Health Administration (OSHA) and the Federal Department of Labor have begun to emphasize the importance of addressing mental health in the workplace as key to reducing injury and illness rates among employees. OSHA has noted that recent studies conducted by the Centers for Disease Control and Prevention (CDC) have shown a concerning uptick in suicide rates among working age adults. It can be difficult to discuss mental health in the workplace, as typically that is a space where personal problems are left at the door. However, creating an environment at work where anyone can reach out for help when they are in crisis is necessary to prevent suicides and other long term mental health issues.

In 1999, the National Institute for Occupational Safety and Health (NIOSH) published an educational study which asserts that stressful job conditions, in combination with individual and situational factors, contributes to a higher risk of injury or illness. To this day, NIOSH maintains that job-related stress can lead to poor health and even injury for workers. Reducing job-related stress from the workplace is important in ensuring that everyone has access to a healthy and safe work environment.

To better illustrate how job stress can impact individuals, the CDC reviewed the specific work conditions that can lead to adverse mental health outcomes. The CDC states that the workplace can contain several factors which have been shown to contribute to higher suicide risks among workers. The reduction of these factors may lead to better mental health outcomes for employees:

– Low job security, low pay, and job stress

– Access to lethal means (e.g. the ability to obtain things such as firearms and medications)

– Long working hours

– Workplace bullying

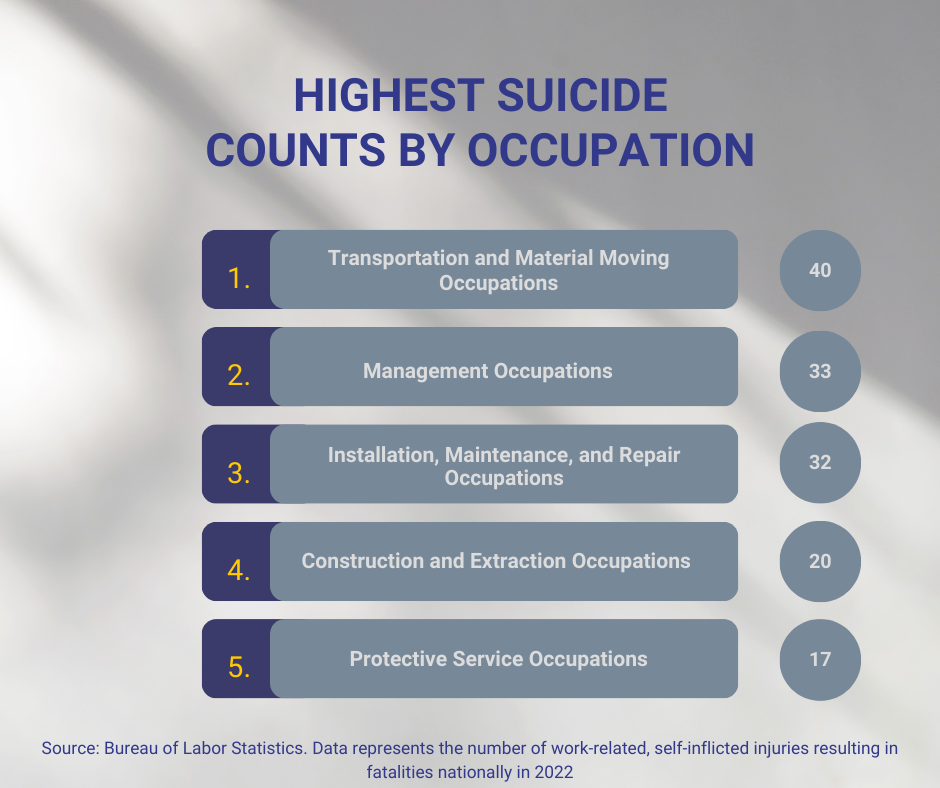

The month of September is National Suicide Awareness month. The effects of suicide can impact individuals in any industry or occupation. There are however, concerning trends that show a higher prevalence of suicide in some occupations than others.

As shown in the data table to the right, these occupations demonstrated the top five highest counts of work-related suicide during the reference year 2022. Transportation and Material Moving workers had the highest count of work-related suicide nationally in 2022. In the Commonwealth of Virginia, Transportation and Material movers made up over 300,000 of the state’s workers in 2023. In total, all of these occupations amounted to 976,810 workers in the commonwealth that year.

As shown in the data table to the right, these occupations demonstrated the top five highest counts of work-related suicide during the reference year 2022. Transportation and Material Moving workers had the highest count of work-related suicide nationally in 2022. In the Commonwealth of Virginia, Transportation and Material movers made up over 300,000 of the state’s workers in 2023. In total, all of these occupations amounted to 976,810 workers in the commonwealth that year.

This month, we aim to honor those who lost their lives and encourage further education and awareness concerning mental health in the workplace. It’s important to know resources are available to individuals who are struggling and those who want to learn more about how they can help those in need and support their colleagues.

If you or someone you know is struggling or in crisis, help is available. Call or text 988 or chat 988lifeline.org to reach the 988 Suicide & Crisis Lifeline.

Virginia Department of Labor and Industry Recertifies the Babcock & Wilcox Company, in Newport News

RICHMOND – The Babcock & Wilcox Company in Newport News, Virginia has received recertification as a Virginia STAR Worksite under the Virginia Occupational Safety and Health (VOSH) Voluntary Protection Programs (VPP).

“We commend the dedication of the staff and management at the Luminant Hopewell Power Plant for prioritizing workers’ safety and health,” said DOLI Commissioner Gary Pan. “This achievement demonstrates their commitment toward keeping workers safe.”

The Babcock & Wilcox Company in Newport News is one of 37 current participants in Virginia’s VPP STAR Program. The facility is part of the Babcock & Wilcox Controls and Electrical Division which designs Electrostatic Precipitator (ESP) Control Systems for worldwide use.

The Virginia VPP recognizes and promotes exceptional safety and health management systems for Virginia’s employers in all industries. In VPP, the participant’s management, workers, and VOSH establish a cooperative relationship that encourages continuous improvement in worksite safety performance.

Acceptance into Virginia’s VPP is confirmation and recognition that an employer has achieved safety and health excellence well above their industry peers. The VOSH VPP administers the Virginia STAR, Virginia Challenge, VADOC Challenge, Virginia BEST, and Virginia BUILT programs. For more information about this program or the other services we offer, visit our website at https://www.doli.virginia.gov/voluntary-protection-program/

The Virginia Occupational Safety and Health (VOSH) program is financed in part by a grant from the U. S. Department of Labor, Occupational Safety and Health Administration (OSHA), under §23(g) of the Occupational Safety and Health Act of 1970. The Virginia State Plan is funded by a grant of federal funds, which constitutes 50% of the State Plan budget excluding any state overmatch funds. Zero percent, or $0.00 of the State Plan budget, is financed through nongovernmental sources.

Virginia Department of Labor and Industry Launches New System for Virginians to Request Youth Employment Certificates

RICHMOND, VA – The Department of Labor and Industry (DOLI) is pleased to announce the launch of a new modern electronic system streamlining the issuance of Youth Employment Certificates. The new system modernizes the three-step process to allow youth workers, their parents, and the employers to request a certificate in a matter of minutes, without delay or the need for a paper application.

“This launch represents another important milestone for DOLI.” said Gary G. Pan, DOLI Commissioner. “This system marks an achievement in modernization for the Agency and supports the Governor’s initiative to introduce the next generation of workers to the Commonwealth of Virginia’s workforce and economy.”

In Virginia, all youth workers, ages 14 and 15, are required to obtain an Employment Certificate prior to performing any work. When a youth worker receives a job offer, they can go online to initiate their certificate application. Once completed, the potential employer will verify the information and enter information about the worker’s job duties. Lastly, the worker’s parents or legal guardian will approve the employment, and the application will be forwarded to DOLI for approval.

This innovative system is part of DOLI’s ongoing commitment to improving services and accessibility for all businesses and employees, making it easier for individuals to obtain required certifications and report wage-related issues. This marks the first-time youth employment opportunities have been integrated into an online portal.

To access DOLI’s online portal, please visit: selfserviceportal.doli.virginia.gov

About the Agency:

It is the mission of the Virginia Department of Labor and Industry (DOLI) to make Virginia a better place in which to work, live, and conduct business. DOLI’s Labor and Employment Law Division administers and enforces the laws of the Commonwealth that govern employee pay, the employment of children, and certain other statutes that relate to the workplace. Additional information about coverage and requirements can be obtained by contacting the Division of Labor and Employment Law at (804) 786-2706 or at laborlaw@doli.virginia.gov.

Virginia Department of Labor and Industry Recertifies Sunoco, LLC in Virginia Beach as a Voluntary Protection Program ‘STAR’ site

RICHMOND – Sunoco, LLC has received recertification as a Virginia STAR Worksite under the Virginia Occupational Safety and Health (VOSH) Voluntary Protection Programs (VPP).

“We commend the dedication and determination of the staff and leadership at Sunoco for prioritizing occupational health and safety,” said Gary G. Pan, Commissioner of the Department of Labor and Industry. “This achievement demonstrates their outstanding commitment toward keeping their workers safe.”

Sunoco, LLC is one of 37 current participants in Virginia’s VPP STAR. The terminal receives petroleum products via barges into its two above-ground storage tanks for distribution to the nearby Oceana Naval Air Station. The facility is situated on 50 acres- and began operations in 1963.

Virginia Voluntary Protection Programs recognize Virginia employers, in any industry, demonstrating exceptional safety and health management systems. The programs are a collaboration between company management, employees, and VOSH staff to establish a cooperative relationship that encourages continuous improvement in worksite safety performance. VOSH VPP administers the Virginia STAR, Virginia Challenge, VADOC Challenge, Virginia BEST, and Virginia BUILT programs.

For more information about this program or services offered through the Voluntary Protection Programs, visit www.doli.virginia.gov/voluntary-protection-program/.

The Virginia Occupational Safety and Health (VOSH) program is financed in part by a grant from the U. S. Department of Labor, Occupational Safety and Health Administration (OSHA), under §23(g) of the Occupational Safety and Health Act of 1970.

About the Virginia Department of Labor and Industry

DOLI is an executive branch agency, under the Virginia Secretary of Labor, overseeing the Virginia Occupational Safety and Health (VOSH) program, Division of Boiler and Pressure Vessel Safety, and Division of Labor and Employment Laws. DOLI strives to make Virginia a better place in which to live work, and conduct business

Statutory Virginia Minimum Wage Increase Effective January 1, 2025

During the 2020 Regular Session, the General Assembly reenacted the Virginia Minimum Wage Act. The new statute stated the Commissioner of Labor and Industry shall establish the adjusted state hourly minimum wage by October 1, 2024, to take effect on January 1, 2025, and then annually thereafter, if the General Assembly did not reenact scheduled increases to the minimum wage rates.

Accordingly, it is the duty of the Commissioner of the Virginia Department of Labor and Industry (DOLI) to establish the adjusted state hourly minimum wage effective January 1, 2025. Pursuant to the Virginia Minimum Wage Act, the adjusted minimum wage rate shall be a sum of the current minimum wage rate ($12.00 per hour) and a percentage of the current minimum wage rate equal to the change in Consumer Price Index for all items, all urban consumers (CPI-U) for the most recent calendar year, as calculated and published by the United States Bureau of Labor Statistics. The U.S. Bureau of Labor Statistics defines the Consumer Price Index as “a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.”

In December 2023, the U.S. Bureau of Labor Statistics published an annual increase in CPI-U of 3.4%. Effectually, the nondiscretionary formula for adjusting the Virginia minimum wage rate is $12.00 + ($12.00 x .034). This calculation equals $12.41. This adjusted rate will be in effect from January 1, 2025 to January 1, 2026.

For the period of January 1, 2025, until January 1, 2026, the established adjusted state hourly minimum wage is $12.41 per hour. Employers must pay all employees covered by the Virginia Minimum Wage Act at a rate not less than the adjusted minimum wage rate.

Annual adjustments to the Virginia minimum wage rate will continue in future years by this same methodology. For questions regarding this calculation or Virginia’s minimum wage laws, please contact the Department of Labor and Industry’s Division of Labor and Employment Law at (804) 786-2706 or laborlaw@doli.virginia.gov.

DOLI sent a letter to business groups in Virginia, to provide notification of the increase, and a copy of the letter can be found here.

DOLI also provides an optional notice, which employers may post for awareness, a copy can be found here.

Virginia Department of Labor and Industry Recertifies Eastman Performance Films as a Voluntary Protection Program ‘STAR’ site

RICHMOND – Eastman Performance Films has received recertification as a Virginia STAR Worksite under the Virginia Occupational Safety and Health (VOSH) Voluntary Protection Programs (VPP). This is the site’s third recertification since 2010.

“We commend the dedication and determination of the staff and leadership at Eastman Performance Films for prioritizing occupational health and safety,” said Gary G. Pan, Commissioner of the Department of Labor and Industry. “This achievement demonstrates their outstanding commitment toward keeping their workers safe.”

Eastman Performance Films, LLC, in Fieldale, Virginia is one of 37 current participants in the Virginia VPP STAR program. The site manufactures a variety of film products sold under Eastman’s portfolio of brands. These products are distributed worldwide and are used for window film on homes, buildings, and cars to provide safety and security for windows, touchscreen displays, medical packaging, theatrical lighting, and car molding, among many other uses. The Fieldale site includes production, warehousing, and administrative facilities for the company. The facility is continuously operated with production employees and includes more than 400 employees.

Virginia Voluntary Protection Programs recognize Virginia employers, in any industry, demonstrating exceptional safety and health management systems. The programs are a collaboration between company management, employees, and VOSH staff to establish a cooperative relationship that encourages continuous improvement in worksite safety performance. VOSH VPP administers the Virginia STAR, Virginia Challenge, VADOC Challenge, Virginia BEST, and Virginia BUILT programs.

For more information about this program or services offered through the Voluntary Protection Programs, visit www.doli.virginia.gov/voluntary-protection-program/.

The Virginia Occupational Safety and Health (VOSH) program is financed in part by a grant from the U. S. Department of Labor, Occupational Safety and Health Administration (OSHA), under §23(g) of the Occupational Safety and Health Act of 1970.

Protecting Workers from the Effects of Heat

Every year, dozens of workers die and thousands more become ill while working in hot or humid conditions. VOSH’s Heat Illness Prevention campaign educates employers and workers on heat hazards and provides resources to keep workers safe.